The Simple Money Playbook for Crypto Cycles: How to Survive the Crash and Profit from the Boom

Crypto Cycle Key Points

- Cycles Are Fast: Crypto cycles are very quick (from 1 to 4 years max). Snooze, you lose.

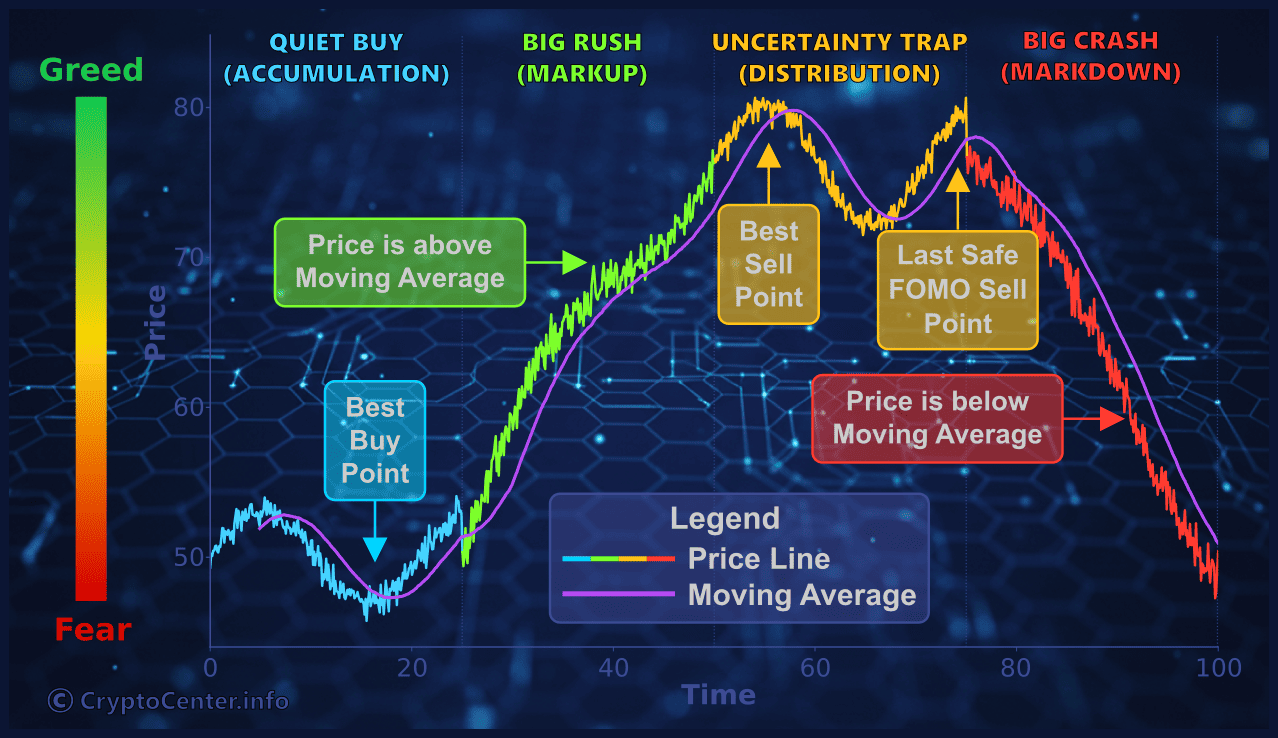

- Only 4 Phases Matter: Every time, the crypto market moves from the Quiet Buy (Accumulation) to the Big Rush (Markup), the Uncertainty Trap (Distribution), and the Big Crash (Markdown).

- Profit Rule #1: In the Big Rush, you must sell portions into strength. Take your cash out after big jumps; don’t wait for the top.

- Survival Rule #1: In the Big Crash, you only survive by Dollar-Cost Averaging (DCA). Buy slowly and only when prices are deeply discounted.

- Stop Trading on Vibes: Use actual data. Watch for the Halving, on-chain whale selling, and the Fear-Greed Index.

The 5 W’s: A Crypto Cycle Overview

What is it? The predictable, repeating pattern of massive booms and brutal busts that controls the crypto market.

Why does it happen? It’s driven by the Bitcoin Halving (cutting supply), huge amounts of easy money (liquidity), and mass investor emotion (FOMO vs. Fear).

When does it happen? The full cycle completes over a compressed 1 to 4 years, making the moves fast and violent.

Who profits? “Smart money” (professionals) who buy when everyone is scared. “Retail investors” (the average crowd) usually jump in late and get wiped out.

Where are we now? The market is always moving. Check the signs: If your friends are excited, you are likely in the Big Rush or Uncertainty Trap phase.

Crypto Cycle Map: Timing Your Buy and Sell Points

You watch the news, and one week Bitcoin is crushing it. The next week, it’s a disaster. That feeling is the Crypto Cycle, and knowing how and why it unfolds is the only thing that matters.

If you don’t know where we are in that cycle, you’re gambling. If you do know, it’s a money-making machine.

This guide tells you exactly how to tell what phase the market is in, and what you need to be doing to buy low, sell high, and keep your cash.

The 4 Stages of the Money Cycle

The market always goes through the same four stages—they are relatively simple, somewhat predictable, and always repeat every cycle. Your job is to know which stage we’re in so you can take the right action. (This cycle is a common model in financial analysis, applied to crypto by major institutions like Investopedia and Ledger Academy.) (Source: Investopedia)

The Quiet Buy (Accumulation)

What it looks like: Prices are cheap. Everyone is depressed. The news is full of stories about people who lost money. Nobody is talking about crypto at work.

The Smart Money Move: This is when the big, serious players quietly start buying. They are stacking up coins for pennies while the average person is too scared to look. (Source: Investopedia)

Your Job: Buy slowly. This is your best chance to make money with crypto. Split your money into chunks and buy every few weeks. You are buying other people’s fear.

The Big Rush (Bull Market / Markup)

What it looks like: Prices are going wild. You see coins double, then triple. Your friends start asking you how to buy Bitcoin.

The Smart Money Move: Smart money is already in from the Quiet Buy phase. When the public “Fear of Missing Out” (FOMO) kicks in and prices start soaring, this is the time for smart money to start their methodical exit strategy by selling small portions while the price is increasing.

What Drives It: This stage is triggered by a combination of factors, primarily:

- The Bitcoin Halving: (Cutting new supply)

- New Cash: Huge waves of institutional or “easy money” flowing into the market.

- Mass Emotion: Widespread public excitement (FOMO).

Your Job: Stop being greedy and start selling portions. This is the time to start taking your original cash out of the game and locking in some profit.(More on this below).

The Uncertainty Trap (Distribution)

What it looks like: The price swings wildly up and down near the high. You have huge green days followed by scary red days. It feels completely confusing, leading investors to second-guess themselves.

The Smart Money Move: They are almost done selling. They are selling the last of their coins to the people who are jumping in late. They create enough final excitement (or “upthrusts”) to sucker in the last few buyers before the crash.

Your Job: Sell more portions! The market is warning you the party is ending. Do not buy anything new. Get your cash out.

The Big Crash (Bear Market / Markdown)

What it looks like: Prices drop 50%… 60%… maybe 80%. Everything feels hopeless. The historical reality is that major market crashes have resulted in drops of 70% to over 80% from the prior peak.

The Smart Money Move: They are chilling on the sidelines with their piles of cash. They wait for the market to drop so low that people start panicking and selling coins for almost nothing.

Your Job: Just wait. If you still have coins, don’t sell in a panic; go into HODL mode. Get your next buying plan ready. This phase resets the whole game for the next boom.

The Money-Making Rules: What to Do Right Now

The Bull Market Playbook (When Prices Are Flying)

Goal: Take Cash Out and Lock In Profit.

The ‘Get Something Back’ Rule of Thumb (The Psychological Edge)

: This rule is for reducing your risk exposure and creating the peace of mind necessary to hold the rest. By taking a small slice of money out, you ensure that if the market suddenly crashes, you won’t lose it all. This provides the psychological resolve to stick with your remaining, higher-risk coins.Calculate your average purchase price

(the total amount you spent on a coin divided by the total coins you own). When the price of the coin climbs 30% or more above your average purchase price, you should sell 10-20% of your total holding of that specific coin. Put that money straight into your bank account.Get Your Original Cash Back (The True De-Risking Step)

.The second your coin doubles (100% gain), sell enough to get your initial investment back.From this point onwards, the rest of your coins are running on “house money.” You are now in profit and cannot lose your initial capital.

The Profit Maximizer (Systematic Selling)

: This is the rule for ensuring you make a profit on the remaining high-risk coins. After securing your initial investment (Rule 2), you must sell gradually into the rising market to realize profit before the peak.Continue selling smaller portions (e.g., 5-10%) at set price intervals or timeframes throughout the Big Rush (Markup) phase.The goal is to sell the majority of the remaining coins before the Uncertainty Trap.

- Final Warning: Do Not Fall for Paper Wealth. The single biggest mistake is being a millionaire on paper

but failing to execute your sell plan. Stick to your rules (Points 1, 2 and 3), and secure your cash.

If you haven’t sold any crypto coins, you haven’t made any money.

The Bear Market Playbook (When Prices Are Dropping)

Goal: Stack Coins Cheaply.

Wait for the real panic

. Stop and look around. You want to buy when everyone else is miserable and the news is toxic. That’s the mood of a bottom.Use Your Simple Tool

: The Average Line. On your charts, you’ll see a line called the “Moving Average.” Think of it as the coin’s long-term average cost. It filters out the daily noise and provides the most reliable signal.Your Buy Rule: Only add new cash when the price has been consistently below that average line for some time (it could be weeks or even months) and shows signs of flat, sideways trading (i.e., the price has stopped crashing). This consistency is your signal that the panic is over and coins are settling at their cheapest.Know the risk

. The average crash for smaller coins is 70% to 80% from the high. Even Bitcoin typically drops into this severe range. Use a 50% drop as a signal that things are finally getting cheap enough to start watching that Average Line. (Source: NYDIG)Buy slowly, using portions

. Use Dollar Cost Averaging (DCA) to purchase new coins. If you have $1,000, split it up and buy a small amounts, slowly over time. This averages out the highs and lows, and also prevents you from running out of cash before the price hits rock bottom.Hold the good stuff (And the Winners)

. Focus most of your money on Bitcoin (BTC) and Ethereum (ETH). They always bounce back.For your “extra bet” money, look at the Top 10 to 20 coins that survived the last major 70%+ crash. If they crashed hard and came back strong once, they are your best bet to repeat it.

The One Rule You Can’t Break

Treat crypto like a small casino fund. If you lose all of it, your life can’t change. If you win big, great. This one rule keeps you calm and stops you from panic-selling when the crash comes.

Frequently Asked Questions

Is the Crypto Cycle always 4 years?

▼What is the “Moving Average” in the chart?

▼Should I sell all my Bitcoin in the Uncertainty Trap (Distribution) phase?

▼If you have followed the playbook correctly:

- You have significantly reduced your exposure by selling a small portion (Rule 1), guaranteeing

that you won’t lose it all if the market crashes immediately.

- You have successfully recovered all of your initial investment (Rule 2).

- The remaining high-risk coins should have been sold off methodically throughout the Big Rush (Markup) phase.

The Uncertainty Trap is a period of extreme market volatility that naturally occurs near the peak. Smart money exploits this phase by using the large price swings to offload their final holdings to late retail buyers.

Action: If you still have any coins left at this stage, aggressively liquidate them all immediately. Finish your sell plan completely. Do not let paper wealth or final volatility trick you into holding coins into the Big Crash.

What drives the crypto market cycles?

▼How do I know when the “Big Crash” (Markdown) phase is over?

▼- Time: The bear market lasts at least 9 to 12 months.

- Price: The price has dropped below its Moving Average line and has stopped falling, showing an extended period of sideways trading (the Quiet Buy (Accumulation) phase).

Your playbook provides three clear rules for selling during a bull run:

- The ‘Get Something Back’ Rule (The Psychological Edge)

You sell the first portion of your coins (10-20%) when the price is 30% above your average purchase price. The purpose of this step is to reduce your initial risk exposure, guaranteeing that you have a slice of capital protected if the market crashes. This provides the psychological resolve to hold the remaining, higher-risk coins.

- Get Your Original Cash Back (The De-Risking Step)

The moment your investment doubles (a 100% gain), sell just enough to recover all of the money you initially invested. At this point, the rest of your coins are running on “house money,” meaning you have secured your principal and cannot lose your initial capital.

- Systematic Final Exit

After securing your cash, you continue to sell smaller portions (e.g., 5-10%) at set price intervals or timeframes throughout the Big Rush (Markup) phase. By the time the market enters the dangerous Uncertainty Trap (Distribution) phase, your entire sell plan should be complete, leaving you with cash safely in the bank.

References & Further Reading

This four-phase model is a standard concept in financial analysis, applied to crypto market behavior. Read more on the four phases of market cycles (Investopedia)

The halving event, which reduces new coin supply, has historically preceded the major bull runs, creating the cyclical nature of the market. Read about the Bitcoin Halving and its market impact (Investopedia)

Major drawdowns (drops) of 70% or more are a recurring feature of Bitcoin’s history after major cycle peaks. See historical Bitcoin drawdowns (NYDIG)

Foundational Theory and Proof

This four-phase model is the foundation of modern technical analysis, showing how institutional “smart money” systematically buys from panicked sellers and sells to FOMO buyers. Read more on the Wyckoff Market Cycle and its four phases (Investopedia)

Academic research confirms that the programmed supply shock from the Halving is a primary driver, correlating strongly with the start of a new bull cycle 12–18 months later. Review Bitcoin Scarcity Models and Time Series Analysis (MDPI)

The ‘Get Something Back’ Rule is a direct countermeasure to the behavioral bias of Loss Aversion, giving you the psychological resolve to hold your remaining coins. Review Prospect Theory: An Analysis of Decision under Risk (Kahneman & Tversky, 1979)

This combines the classic risk-mitigation strategy of DCA with technical analysis, only adding new capital when the price is consistently below the long-term average (like the 200-day MA). Learn more about Dollar-Cost Averaging as a risk-mitigation strategy (Investopedia)