What Is Cryptocurrency, and How Is It Used? A Practical Guide for Beginners

Key Cryptocurrency Takeaways

- Crypto is digital money: It’s a type of digital currency that lets you send money online without needing a bank or other financial institution.

- Blockchain is the engine: The technology that powers most cryptocurrencies is called blockchain. It’s a shared, permanent record of all transactions that’s secured by a network of computers.

- You are your own bank: When you use crypto, you are responsible for the security of your funds. The most important thing to remember is to keep your private keys safe, as they are the ultimate proof of ownership.

- It’s a two-sided coin: Crypto offers incredible opportunities for investing and financial freedom, but it comes with real risks like volatility, scams, and hacks.

- The technology is still new: The crypto space is constantly changing and evolving. It’s important to do your own research, start small, and learn as you go.

The 5 W’s of Cryptocurrency

Who: Anyone with internet access can use cryptocurrency.

What: Digital currency secured by blockchain technology.

Where: Accepted worldwide — online and in some physical stores.

When: First appeared in 2009 with Bitcoin; now thousands of options exist.

Why: Offers fast, borderless, low-cost transactions and new earning potential.

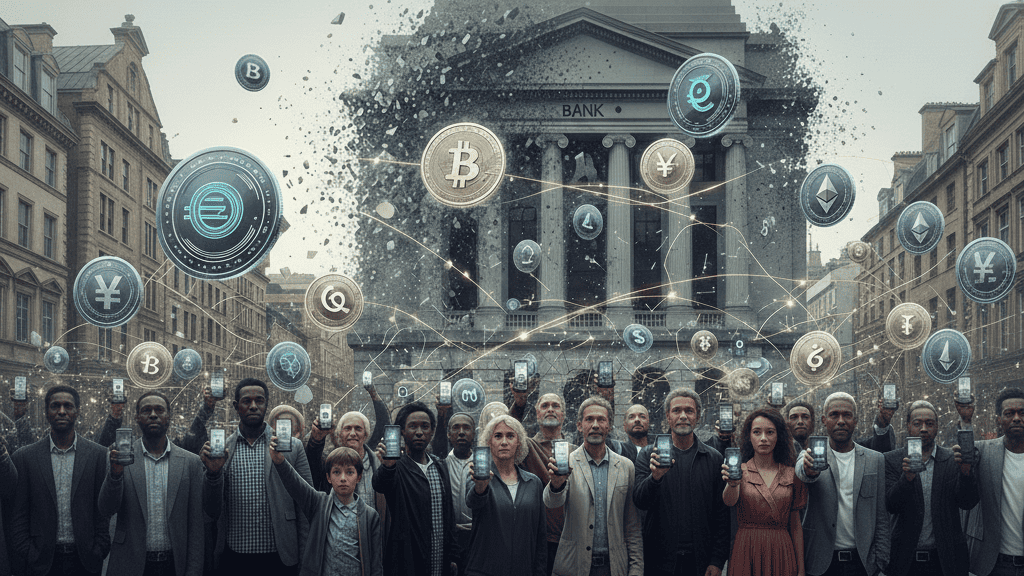

Welcome to the future of money. This is what it looks like when a new, decentralized financial system begins to replace the old one.

Cryptocurrency, in Brief:

Cryptocurrency Explained Simply

Cryptocurrency is digital money anybody can send over the internet without a bank. Complex computer coding using cryptography secures it, and it runs on public databases called blockchains.

People use cryptocurrency to:

- Move money across borders

- Save

- Invest

- Use apps called DeFi

- Send “dollars” on-chain with stablecoins

The Engine Powering Cryptocurrency

Most cryptocurrencies use a core technology called blockchain. Think of it as a shared, immutable digital ledger.

Huh???

Huh???

Imagine a game of playground football… where there’s no referee and everyone keeps the score in their head.

The score is the ledger—a shared, agreed-upon record of events.

In this game:

- Every player (node – more on this later) has the same score in their head.

- Nobody can change the score without convincing the majority of players that a new score is correct.

- The score is immutable because it’s nearly impossible for one player to successfully lie about it.

- This system works because everyone agrees to follow the rules, achieving consensus without a referee (central authority).

The game is a decentralized peer-to-peer network of participants (the players/nodes) keeping an identical, unchangeable record of events (the score/ledger). (Source: Martin Jee’s Blog)

Nodes and Their Role

In the crypto world, we call computers “nodes”. These nodes are the building blocks of the entire blockchain network. Instead of a single central server managing everything, the network’s data is distributed across thousands of these individual computers. All nodes are:

- Interconnected: Every node on the network is in direct communication with one another. They continuously share information about new transactions and new blocks of data. This creates a powerful, decentralized web where no single point of failure exists.

- Responsible for the Records: Each node maintains a complete and identical copy of the entire blockchain’s ledger. When a new block of transactions is created and verified, every node on the network adds that new block to its own copy of the chain. This is what makes the blockchain “distributed” and incredibly secure.

The Importance of Decentralisation

Because there is no central authority, the network is incredibly difficult to manipulate. This ensures every cryptocurrency transaction is secure.

How secure?

Let’s assume somebody wants to tamper with a cryptocurrency transaction. They would have to simultaneously hack a majority of the thousands of nodes around the world.

Such tampering is nearly impossible.

Furthermore, blockchain security is enhanced as more blocks are added to the chain. Each additional block makes it more difficult, and more costly, to alter a previous transaction.

How is a New Block is Added to the Blockchain?

The two primary methods of adding a new block of cryptocurrency transctions to the blockchain are:

- Mining (Proof-of-Work): This is the method Bitcoin uses.

It is a process where powerful computers compete to solve complex mathematical puzzles involving cryptography.

The first computer to solve the puzzle gets to add the next “block” of transactions to the blockchain, and is rewarded with new cryptocurrency.

- Staking (Proof-of-Stake): This is the method Ethereum uses.

Instead of competing with computing power, participants “stake” their own cryptocurrency as a form of collateral to validate transactions.

The protocol randomly selects a staker to add the next block, and they are rewarded for their participation.

How a Cryptocurrency Transaction Works

In traditional banking systems, you own the money in your account, but the bank controls the ledger and authorizes all transactions.

You tell the bank what to do and use a password or PIN to authorize the transaction, but it is the bank actually moving the funds.

In the crypto world, cryptocurrency is digital and stays on the blockchain, the balance of any crypto account is kept in a wallet.

As such you personally never own or hold cryptocurrency, you own an pseudo-anonymous wallet which has a balance recorded on the blockchain.

Each wallet has a public address (like your email) and a private key (like your password).

Public Address: The Destination

The public address (also called the wallet address) is what you give to people to receive cryptocurrency.

Pretty much like an email address—anyone can have it, and you can share it completely safely.

It’s the public destination for funds on the blockchain.

Private Key: The Signature

This is one of the most important parts of the blockchain system.

The private key is a secret, unique cryptographic code. It is the ultimate proof of ownership.

To send crypto from your public address, you must use your private key to “sign” a transaction.

This digital signature is cryptographic proof that you, and only you, are the owner of the cryptocurrency and have authorized the transfer.

The Transaction Process

When sending crypto, your wallet software does the following:

- It creates a transaction request: This message specifies the amount you’re sending and the recipient’s public address.

- It signs the transaction: Your wallet uses your private key to create a unique digital signature for that specific transaction.

- It broadcasts the request to the network: Your wallet sends the signed transaction to the network of computers (nodes) that maintain the blockchain.

- The network confirms the transaction: The nodes verify the digital signature using your public key.

They can confirm that the transaction was authorized by the correct private key without ever needing to know what

your private key is.

Once confirmed (by numerous nodes), the transaction is added to a new block on the blockchain, and the balances are updated.

So, in short: A private key fundamentally controls and authorizes transactions, which are then recorded on the public ledger between public addresses (not people).

Make sure that person is you!

Securing Your Digital Wealth: The Cryptocurrency Wallet

Unlike physical wallets that hold cash, a cryptocurrency wallet doesn’t technically “store” your digital currency.

Instead, it holds the public and private keys that prove your ownership of cryptocurrency on the blockchain, and allows you to initiate transactions. (Source: Coinbase)

Crypto wallets are available in several types, with a trade-off between security and ease of use for each:

Software Wallets (Hot Wallets):

You can access these applications online (web wallets), on your desktop, or on your mobile device.These wallets may be convenient for frequent transactions, but their continuous connection to the internet makes them less secure than hardware wallets.

There are two type of software wallets:

Hosted Wallets:

We know these as custodial wallets. These are wallets controlled by a third-party, like a cryptocurrency exchange such as Coinbase or Kraken for example.When you open an account and buy crypto on an exchange, the exchange initially stores it in a hosted wallet.

Pros: Perfect for beginners and small transactions because the exchange is responsible for the security of your keys and your crypto balances.Cons: You are limited in what you can do with your crypto, and you could lose your crypto if hackers target the exchange or it goes out of business.Self-Custody Wallets:

A self-custody wallet is a program or app that you install and operate on your computer or mobile device.When you create a self-custody wallet, the system gives you a unique “seed phrase” (a series of 12 or 24 words). This seed phrase is the master key to your wallet and you can use it to restore it on any compatible device.

The wallet provider has no access to this phrase. You must keep the seed phrase and keys in a safe place.

Pros: More secure than a hosted wallet, and you have full control over your crypto.Cons: You must secure your own keys from all threats, including malware, phishing attacks, and physical loss.

Hardware Wallets (Cold Wallets):

These are physical devices that store your private keys offline, making them highly secure against online hacks.To make a transaction, you plug the device (which often looks like a USB drive) into a computer or mobile device.

The device initiates the transaction, but it cryptographically signs it offline inside the hardware wallet. The hardware wallet then sends the signed transaction to the blockchain, but your private key never leaves the device.

Lose them and you lose your crypto!

How does a beginner start in cryptocurrency?

There is nothing complicated about buying cryptocurrency. The steps are relatively simple:

Open an account on a reputable exchange.

Binance or Kraken are good, and are beginner friendly. People know Coinbase as a good exchange, but we had technical problems when trying to join, so we cannot comment…

To open an account you will need:

- A valid email address which you have to verify.

- A valid phone number which is necessary for two factor authentication (2FA).

- On some exchanges be prepared to enter your name and address, but your name is never visible to others.

- A valid identification document which must include a recent photo for know your customer (KYC) regulations.

Purchase your crypto.

Each exchange will have a particular method for purchasing cryptocurrency, often using a credit/debit card or bank transfer.

We do not endorse using a credit card. Getting into debt to purchase cryptocurrency is not a good thing to do…

First Time Crypto Purchasing Tips

- Start Secure: Use strong passwords, and set up two factor authentication.

- Start Small: The current minimum on Binance is $15, so start with that.

- Start Safe: Use a debit card, or positive bank balance to fund an exchange. Never use a credit card or borrow money to fund crypto.

- Start Stable: Stable coins like USDT are normally pegged pretty close to the US$ so they are great for “learning the ropes” – although you can also make “safe” buys with Bitcoin and Ethereum.

What Do I Do After Buying Crypto?

1) Secure Your Assets

The single biggest priority with cryptocurrency is securing it.

Private key compromises accounted for the largest share of stolen crypto in 2024, at 43.8% (Source: Chainanalysis.com Crypto Hacking)

According to blockchain security company Certik, during the first six months of 2025, criminals stole $2.47 billion from cryptocurrency owners through hacks and scams. Of that:

- $1.7 billion was stolen through compromised crypto wallets.

- $410.74 million was stolen through phishing attacks. (Source: HACK3D Security Report)

Moreover, there has been a major crypto exchange go bankrupt in virtually every continent:

- Mt. Gox (Japan)

- QuadrigaCX (Canada)

- Cryptopia (New Zealand)

- FTX (USA)

- ACX (Australia)

- Hodlnaut & OPNX (Asia)

What is more, hackers are continuously targeting crypto exchanges. For instance, in 2022 hackers hit Binance for $570 million.

Given these points, here are the key crypto security takeaways:

- For long-term storage, crypto exchanges are not the safest place for your assets. You should get ‘excess idle’ crypto off an exchange and into a secure wallet.

- A wallet is only as secure as your computer or mobile device. Consider using a virtual private network (VPN), the best anti-virus software, and a strong firewall.

- Your wallet seed phrase is only used to restore a wallet. Under no circumstances use it for anything else, or give it to anybody, especially if asked in an email or phone call.

- Your wallet private key is used to authorize cryptocurrency transactions. As with the seed phrase, under no circumstances use it for anything else, or give it to anybody, especially if asked in an email or phone call.

2) What’s Next? Exploring the Crypto Ecosystem

Many people think of crypto as just something to buy and sell. In reality, it’s actually a vast ecosystem with many opportunities to explore. Here are two of the most popular ways people are using their crypto today.

Interacting with Decentralized Finance (DeFi)

Imagine a financial system that works without banks or any other middlemen. That’s essentially what Decentralized Finance (DeFi) is. It’s a world of financial services—like saving, borrowing, and lending—built on the blockchain, run by computer code instead of companies.

“Lending” your crypto is the simplest way to get started. A bank pays you interest for depositing your money. In similar fashion, some DeFi platforms reward you for lending your crypto to others.

The crypto community often calls this ‘yield farming’, and it’s a way for you to earn passive income on the crypto you already own.

How and Where Do I Start?

To get involved with DeFi, you’ll need to use a crypto wallet that connects to these decentralized applications. Think of it as a special browser for the crypto world. MetaMask and Coinbase Wallet are two of the most popular and user-friendly options for beginners.

- Get a Wallet: Download a wallet like MetaMask or Coinbase Wallet.

- Fund Your Wallet: Transfer some of your cryptocurrency from the exchange where you bought it to your new wallet.

- Find a DeFi Platform: Research popular, beginner-friendly platforms like Aave or Compound. These are well-established “lending protocols” where you can deposit your crypto and start earning interest.

Understanding and Using NFTs

You’ve probably heard about NFTs in the news, but you might be wondering what they actually are. NFT stands for Non-Fungible Token. Think of it this way: a dollar bill is “fungible,” meaning you can swap one dollar for another, and they have the same value. An NFT, on the other hand, is “non-fungible”—each one is unique and has its own individual value.

What do NFTs represent?

NFTs are digital tokens that prove you are the sole owner of a unique digital item. This can be anything from a piece of digital art to a video clip, a song, or even an item in a video game. NFTs have become a popular way for artists and creators to sell their work directly to fans. For many, collecting NFTs is a fun and modern way to support creators and own a unique piece of digital history.

How and Where Do I Get an NFT?

The most common way to buy, sell, and trade NFTs is through a marketplace. These are like an Amazon or eBay for digital collectibles.

- Get a Wallet: Just like with DeFi, you need a crypto wallet to store your NFTs. Your wallet is where your new digital collectible will live.

- Find a Marketplace: The largest and most popular marketplace is OpenSea. It’s often the best place for a beginner to start because it’s easy to use and has a huge variety of NFTs. Other popular options include Magic Eden (known for lower fees) and Rarible.

- Buy Your First NFT: On the marketplace, you can browse different art collections, bid on items in an auction, or simply buy one at a fixed price. When you find one you like, you’ll use your crypto from your wallet to complete the purchase.

How Can You Make Money with Crypto?

Making money with cryptocurrency goes beyond just buying and selling. It’s about using different strategies to take advantage of the unique nature of digital assets. Here are some of the most common ways crypto can make you money.

Hodling (Holding)

“Hodling” is a term that came from a typo for “holding” in a crypto forum, and it’s now a core part of crypto culture.

It’s the simplest strategy: you buy a cryptocurrency and hold onto it for a long period, typically for months or years, regardless of price fluctuations. The goal is to profit from the long-term appreciation of the cryptocurrency’s value.

Trading

Trading is the opposite of hodling. It involves actively buying and selling cryptocurrencies in the short term to profit from normal market price swings.

This can include day trading, where you make multiple trades in a single day, or swing trading, which involves holding an asset for a few days or weeks to capture a short-term trend.

Staking

Staking allows you to earn rewards by participating in a Proof of Stake (PoS) blockchain. Essentially, you “lock up” your cryptocurrency to help secure the network and validate new transactions.

In exchange for your contribution, you’re rewarded with a passive income, typically paid out in the same crypto you staked.

Trust Wallet, for example, allows staking from within the wallet itself. The cryptocurrency annual percentage yield (APY) varies:

- Tron: APY 20%

- Ethereum: APY 4%-6%

- Solana: APY 2%-7%

- Polkadot: APY 10%-12%

Yield Farming

Yield farming (which we also call liquidity mining) is a way to earn rewards by providing your cryptocurrency to a decentralized finance (DeFi) platform. You “lock up” your assets in a liquidity pool, which helps facilitate trades on the platform.

Here’s a simple breakdown of how it works:

- You deposit crypto: You choose a platform (like Uniswap or Aave) and deposit your cryptocurrency, often in a pair (e.g., ETH and DAI), into a liquidity pool.

- Your assets are locked: Your deposited funds are locked in the pool and are used to help others trade.

- You earn rewards: In return for providing this service, you can earn rewards in a few ways:

- Transaction fees: You get a portion of the fees paid by traders.

- New tokens: The platform may give you new tokens, including “governance tokens” that let you vote on platform decisions.

Be aware of risks: Yield farming can be complex and risky. The biggest risk is “impermanent loss,” which happens when the value of your deposited tokens changes, potentially resulting in a loss compared to if you had just held them in your wallet.

You can withdraw your assets and rewards at any time, though some platforms might have penalties for early withdrawal.

Arbitrage

Crypto arbitrage is a trading strategy that takes advantage of price differences for the same cryptocurrency on different exchanges. For example, if Bitcoin is trading for $50,000 on one exchange and $50,100 on another, an arbitrage trader would quickly buy it on the first exchange and sell it on the second to make a small, quick profit.

This requires speed and is often done with automated trading bots.

The Cryptocurrency Takeaway

You’ve now got the basics of cryptocurrency under your belt. You understand that it’s digital money secured by complex code, and you know how a blockchain works and why it’s so hard to manipulate.

With this knowledge, you are ready to take the next step. Whether you plan to buy and hold a crypto coin for a while, try your hand at staking to earn a reward, or simply learn more about the world of cryptocurrency, the way forward is entirely up to you.

Just remember to:

- Start small

- Stay smart

- Always keep your private keys safe.

Frequently Asked Questions

References

The technical concept of blockchain explained simply. Read the Best Blockchain Analogy Ever

Learn about the essential tool for cryptocurrency: the crypto wallet. This guide demystifies how wallets actually work, what they’re for, and which type is right for you. Read the Crypto Wallet Guide

Nearly $2.2 billion worth of crypto funds were stolen from hacks in 2024. View the Crypto Hacking Report

In the first half of 2025, the crypto industry has already seen more than $2.47 billion in losses due to hacks, scams, and exploits. Read the Security Quarterly Report

Explore the best cryptocurrencies to stake in August 2025 for the highest staking rewards. View the Crypto Staking Guide

A straightforward, high-level overview of what cryptocurrency is, why it was created, and its core concepts. This is a good general resource for anyone wanting a quick summary. Read the Cryptocurrency Overview

A detailed yet accessible explanation of blockchain technology, including its key features like immutability and decentralization. View the Blockchain Explanation

This article breaks down decentralized finance in a simple way, explaining how it works and its advantages over traditional finance. Read the DeFi Beginner’s Guide

A clear and concise guide to non-fungible tokens, explaining what “non-fungible” means and how NFTs are different from cryptocurrency. View the NFT Guide